How to check credit score using Paytm App?

To check credit score using Paytm App, you must have an account on this platform. As you know, Paytm is a multinational technology company that offers financial services, digital payment systems, and e-commerce. Currently, more than 130 million Indians are using the Paytm app. It offers endless financial and payment features that you can access by becoming a user. People are so over with the traditional ways of making payments and receiving money.

Nowadays, instead of carrying cash in their pockets, they prefer making payments via their mobile phones. This way saves a lot of time and effort for an individual however, it has its fair share of risks. Paytm has been there for a long time as it was founded in 2010. You can check your credit score using the Paytm app and that too in minutes. If you are wondering how to do that you can follow the instructions mentioned further in this article.

What is a Credit Score?

Before hovering over to “How to check credit score using Paytm App” we will take a look at what is Credit Score? In a layman’s words, a credit score indicates a person’s creditworthiness or ability to repay debt. This Credit score is based on credit reports that help banks and credit companies to conclude and evaluate potential risks in lending money to a consumer.

So, having a good credit score opens up numerous opportunities for you. Now the question arises what is the idol credit score that can define the right creditworthiness? Well, a credit score between 300-850 is considered as the idol creditworthiness of the consumer. However, the higher the number the better it would look to the potential lenders. If you are wondering how can you check this credit score? There are numerous applications and ways to determine the credit score of an individual such as Paytm, PhonePe, GooglePay, etc.

How to check credit score using Paytm App?

To check credit score using Paytm App you need to make sure that you are an account on this app. Otherwise, you won’t be able to check your credit score using Paytm App. So, if you want to check your credit score from this app then you need to create an account first. Existing users can check their credit score with the help of their PAN card, Date of Birth, and Email Address. There are two ways to check credit score using Paytm App.

The first one is to visit the official website of Paytm by typing paytm.com/credit-score in the search bar. This web address will navigate you directly to the credit score page of Paytm and you will see a QR appearing on the front. You need to scan that QR code and you can check your credit score within seconds.

Another way to check credit score using Paytm App requires you to follow the instructions listed below –

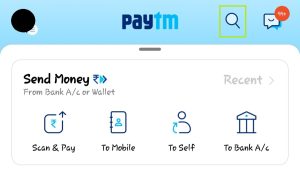

- Open the app and then log in to your account if you aren’t logged in already.

- Now, on the home page, you will see a magnifying icon appearing on the top of the screen, click on it.

- Type “Free Credit Score” in the search bar and then click on the result that appears on the screen.

- On the updates page, you will be asked to enter your PAN card number, Date of Birth, and Email Address. Enter all the details carefully.

- After entering your details, you need to click on the “Check Credit Score” button appearing at the bottom.

Shortly, the screen will show your credit score. You can check credit score using Paytm App anytime, anywhere with the helps of instructions we have mentioned earlier. Other than that, you must know while checking the credit score it may also ask your registered mobile number.

Final Words

That was all about How to check credit score using Paytm App. We hope you find this article helpful and if you have anything to add then you can let us know via comment section. Please adhere to the steps mentioned in this article attentively. If you have any queries and questions then leave them in the comment section.